main street small business tax credit sole proprietor

Report farm income and expenses. Almost everyone who works in the US.

Small Businesses And Taxation Fincor

Each employer is limited to no more than 150000 in credit.

. If youre using your California Main Street Small Business Tax Credit for income taxes you can use it to pay personal California state income tax andor corporate franchise tax. Easy and inexpensive to form. Tax credits directly decrease the amount of tax a small business owes by a dollar-for-dollar amount.

Best for Cash back bonus categories. Advantages of a Sole Proprietorship. The impact of the new Trump Tax laws on sole proprietorship taxes.

That said a small-business tax credit can directly reduce your tax bill. To qualify as an eligible small business average annual gross receipts of the corporation partnership or sole proprietorship for the three prior tax periods cannot exceed. Ad Talk to a 1-800Accountant Small Business Tax expert.

Have fewer than 25 full-time or equivalent employees. As a sole proprietor you are going to have to pay the self-employment tax. It includes updates from the Main Street Lending Program.

The credit is limited to 500or 50 of your startup costs. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax Credit.

As a sole proprietor you have to pay both the employers and the employees portions. Get the tax answers you need. Ink Business Cash Credit Card.

Sole proprietors are considered to be self-employed for the purposes of paying Social Security and Medicare taxes. This bill provides financial relief to qualified small businesses for the economic. Fortunately sole proprietors can deduct half of their self-employment tax.

Visit the 2021 Main Street Small Business Tax Credit II page for more information. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

Get the tax answers you need. You are allowed to take a tax deduction for half of your self-employment taxes. The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed.

For tax years beginning in 2010 businesses are allowed to deduct up to 10000 of business start-up costs--thats double the previous 5000 limit. The qualified business income deduction TCJA introduced a tax benefit for pass-through businesses which includes a TTS trader with Section 475 income. Generally things like a state sales tax and excise tax are required though property and real estate taxes can be levied against the business if it owns a building or property.

For example if a sole proprietor makes 110000 of revenue but is able to deduct 40000 as expenses their taxes. With the passing of the Tax Cuts and Jobs Act TCJA in late 2017 some sole proprietors may be able. Pay an average wage of less than 55000 a.

Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and. This tax pays for your Social. On November 1 2021 the California Department of Tax and Fee.

This is a small business tax credit designed to offset the costs of starting a pension. Schedule F 1040 or 1040-SR Profit or Loss from Farming. TCJA allows owners of pass-through.

The small-business health care tax credit via Form 8941 is available to businesses that. For example a 200 tax credit will decrease a businesss tax bill by 200. We have the experience and knowledge to help you with whatever questions you have.

Best for Flat-rate rewards cash back Capital One Spark Miles for Business. The deduction starts to. We have the experience and knowledge to help you with whatever questions you have.

File it with Form 1040 or 1040-SR 1041 1065 or 1065-B. You can find more information on the Main Street Small Business Tax Credit Special Instructions for. Ad Talk to a 1-800Accountant Small Business Tax expert.

A sole proprietorship is the simplest and least expensive business structure to establish. See reviews photos directions phone numbers and more for Tjh Internet Sole Proprietor locations in Dulles VA. Capital One Spark Cash Plus.

This amounts to 153 of your total income. The Federal Reserve Board created the Main Street Lending Program as an alternative to supplement small. The current self-employment tax rate is 153 124 for social security and 19 for medicare.

Business Tax Deadline In 2022 For Small Businesses

7 Ways Small Businesses Benefit The Community Oliver Pos Blog

Small Businesses And Taxation Fincor

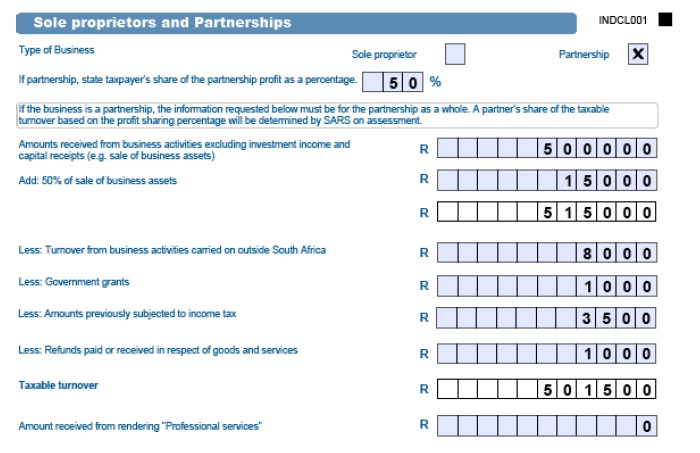

Annual Return South African Revenue Service

Butchers Shop Front High Resolution Stock Photography And Images Alamy

Pin By Am On Commerce Stuff Business Ownership Legal Business Profit And Loss Statement

California Main Street Small Business Credit Ii Kbkg

Butchers Shop Front High Resolution Stock Photography And Images Alamy

The 4 Most Popular Types Of Business How To Choose One 2022

When To Use An S Corp In Your Business Main Street Business Podcast Youtube

Sole Proprietor Or Company What S Best For Tax Taxtim Blog Sa

Benefits Of Bookkeeping Infographic Ageras Bookkeeping Bookkeeping Business Bookkeeping And Accounting

Black Wall Street And The Business Of Creating A Community

California Main Street Hiring Tax Credit

Explore Our Image Of Sole Trader Tax Invoice Template Invoice Template Photography Invoice Template Invoice Template Word

Small Businesses And Taxation Fincor